Blog

I recommend revocable living trusts to almost all of my clients, as a basic foundation to a solid estate plan. When recommending these trusts, or any kind of trust, really, I always stress the importance of actually funding the trusts. After all, a trust cannot protect what it does not own. However, you would be shocked by how many clients do not transfer their assets into their trusts, thus missing out on the desired, and paid for, benefits of trust planning. So, we have long talks about this vital step in estate planning, and the negative impact of not following through. However, one piece of advice that I share with clients, often to their surprise, is my advice to skip funding the trust with vehicles. Here’s why. No Escape from Liability One, contrary to popular belief, you cannot eliminate liability by having a trust own your car. If you cause an accident with a trust owned vehicle, you are still liable. Encouraging Lawsuits Two, if you cause an accident with a trust owned vehicle, you’re probably increasing your chances of being sued. For many, the use of a trust is associated with wealth. Despite the fact that a trust is helpful in virtually ALL financial situations, this stereotype continues. So, it is often the case that if a potential plaintiff (or their attorney) sees that a car is owned by a trust, they assume that deep pockets are involved and are potentially more inclined to sue. Risk to Trust Assets Three, if a vehicle is owned by a trust and is involved in an accident, the trust will be named as a party to the litigation. This potentially makes the trust assets vulnerable to a judgment, and also places a trustee in the position of being named a defendant. Since close friends and trusted family members are often named as trustees, the last way you want to thank them for their contribution is by dragging them into litigation, even if only in their role as trustee. What To Do? So, if you don’t place the vehicles into the trust, how should you handle them? The last thing you want to do is open an estate simply in order to transfer title to vehicles. This happens far too often, and sometimes results in legal fees that exceed the value of the vehicle. Although Ohio law does allow you to transfer two vehicles , with an aggregate value of $65,000 , to a surviving spouse , without opening probate, this ignores the plight of many who may have expensive vehicles, may have more than two vehicles, or may not have a spouse. The good news is that a fix is easy, and just requires a trip to a title agency. At the title agency, you can add someone to your car title, either as a co-owner or as a transfer on death beneficiary . If someone is a co-owner, they own the car with you. This is a great solution for spouses. If they are a transfer on death (TOD) beneficiary, they inherit the car at the time of your death. Either option will avoid probate. They both require a little paperwork after the original car owner dies, but the paperwork is simple and straightforward, and is vastly preferable to opening an estate. This is something that you can do TODAY, without the assistance of an attorney, so why wait? If you have any additional questions, please don’t hesitate to reach out to me at info@LBesq.com or (614) 334-6850.

A Professional Will: Why You Should Make One Today Death is an inevitable part of life, and while it is not something we look forward to, it is important to plan for it. As a professional (doctor, lawyer, therapist, counselor, ect.), you have worked hard to build a successful career, but have you thought about what will happen to your business and clients after you die? Creating a professional will is the solution to this problem. In this blog post, we will discuss what a professional will is, why it is important, and how to create one. What is a Professional Will? A professional will is a legal document that outlines what will happen to your business and clients when you die or become incapacitated. It is different from a regular will because it only deals with your professional life and not your personal assets and property. A professional will ensures that your clients are taken care of and that your business can continue to operate even if you are not there to manage it. Why is a Professional Will Important? A professional will is important because it protects your clients, your business, and your legacy. Without a professional will, your clients may be left in a lurch, and your business could fall apart. This can cause a lot of stress and uncertainty for your clients and loved ones during a difficult time. A professional will also ensures that your hard work is not lost and that your legacy continues. How to Create a Professional Will Creating a professional will is not difficult, but it does require some planning and legal advice. Here are the steps to creating a professional will: Identify Your Successor: Choose someone you trust to take over your business and ensure that your clients continue to receive the same level of care. List Your Clients: Make a list of all your clients and their contact information. This will help ensure that they are notified of your passing and that their care is transferred to your successor. Specify Your Wishes: Decide what you want to happen to your business after you die. Do you want it to be sold or passed on to your children? Specify your wishes in your professional will. Consult a Lawyer: Work with a lawyer to draft your professional will. They will ensure that it is legally binding and that your wishes are carried out. Update Regularly: Review and update your professional will regularly to ensure that it accurately reflects your wishes and any changes to your business. Conclusion: Creating a professional will is an important step in protecting your business, your clients, and your legacy. It ensures that your hard work is not lost and that your clients are taken care of after you die. As a professional, it is important to plan for the future, and a professional will is the first step in that process. Take the time to create your professional will today, and give yourself and your loved ones peace of mind. Call (614) 334-6850 to schedule a consultation today.

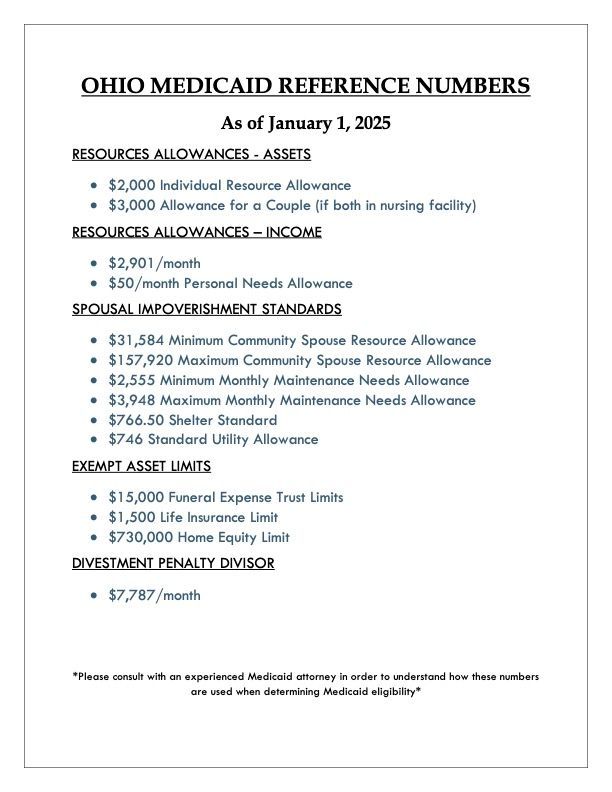

If you or someone you love needs long-term care, navigating the complexities of the Medicaid application process can be overwhelming and stressful. But, it's important to understand the Medicaid spend-down process to assess what benefits and care may be available. A Medicaid spend-down allows individuals to qualify for Medicaid by reducing their countable assets and income to a certain level . It is a daunting task, but with the right guidance and support from a qualified Medicaid attorney, the spend-down process can help accelerate Medicaid eligibility while protecting assets. Understanding Medicaid Eligibility and Spenddown The basic premise of Medicaid spend-down is to reduce an individual's assets and income to qualify for Medicaid coverage. In Ohio, the threshold for eligibility is quite low. In 2025, a single Nursing Home Medicaid applicant must meet the following criteria: Income under $2,901.00 / month Assets totaling under $2,000 Require a Nursing Home Level of Care Up-to-date eligibility information can be found on the Ohio Department of Medicaid's website. To achieve eligibility, individuals may need to "spend down" their assets and/or income on permissible expenses. Additionally, there are complicated methods for converting countable assets into exempt resources, as well as allocating income from the institutionalized spouse to the community spouse, thus preventing the impoverishment of the community spouse. This process is very complex , with strict rules and regulations. Any missteps could result in penalties or delays in eligibility. This is why it is important to work with an experienced Medicaid attorney. The Look Back Period Ohio’s look-back period is a crucial aspect of Medicaid eligibility. When someone applies for Medicaid, Medicaid will require bank statements and other financial records from the preceding five years. An applicant must explain any "improper transfers" (i.e., assets that were given away or sold for less than fair market value). If the applicant made improper transfers, a penalty period may be imposed, during which they'll have to privately pay for nursing home care. List All Assets First, make a list of all your assets. This includes bank accounts, investments, real estate, vehicles, life insurance policies, retirement accounts, and any other assets of value. It is important to know the exact value of each asset, and any potential income generated from them. Review Income Sources Next, review your sources of income. This includes wages, social security benefits, pensions, annuities, required minimum distributions, rental income, etc. Identify Countable and Non-Countable Assets In Ohio, not all of a person's assets count towards Medicaid eligibility. Some assets are exempt and don't count towards the limit. Countable assets include, but are not limited to: Cash Certificates of Deposit Stocks, bonds, and other investments Checking, savings, brokerage and other bank accounts Non-primary residences (such as vacation homes, rental properties, etc.) Non-countable assets include, but are not limited to: Personal belongs (such as jewelry and household items) Furniture The primary home, to a certain extent The primary automobile Life insurance with a cash surrender value under $1,500 Calculate The Medicaid Eligibility Threshold and Spenddown Amount Once you have assessed your financial situation and identified countable and non-countable assets, it is time to calculate the Medicaid eligibility threshold and the spend-down amount. To determine the eligibility threshold, add up all your non-exempt assets, and determine your total income. Then subtract the threshold figures provided for 2024 assets and income. These two figures will give you a general idea of what needs to be reduced through the spend-down process to qualify for Medicaid. Calculating the proper way to spend down assets and income is a quite complicated process, which differs depending on whether the applicant is married or single. Spend Excess Income and Countable Assets Your Medicaid attorney can help you determine expenditures that can be counted toward the spend-down amount. Some examples are: Medical insurance premiums (like health, vision, dental and long-term care) Unpaid medical bills Co-pays and deductibles Paying off debt Prescriptions Physical therapy Legal fees Funeral Home trusts Medical equipment and supplies Transportation costs to get to medical appointments Home modifications Other care-related expenses Convert Countable Assets into Exempt Assets You can also use excess assets to purchase exempt assets. By converting countable assets into exempt assets, you can potentially qualify for Medicaid in Ohio without having to spend your entire savings. There are quite a few options available, and an experienced Medicaid planning attorney can help you determine which strategies are right for you. Transferring Home Ownership To avoid losing your home to a Medicaid lien, you may want to transfer your home ownership. DON’T DO IT without the assistance of a qualified Medicaid attorney. There are very strict rules that govern these types of transfers, and if done improperly, it can lead to Medicaid denials and penalties, as well as adverse tax consequences. This is not an option available to everyone, therefore it is important to consult with a Medicaid attorney before taking this action. Qualified Income Trust If your income exceeds the limit for Medicaid, it may be necessary to establish a Qualified Income Trust, also known as a Miller Trust. Any income over the limit will be placed into the trust and disregarded for Medicaid application purposes. Once you are approved for Medicaid, almost all of your income, including the income placed in the Qualified Income Trust, must be used to pay for care before Medicaid covers the remaining balance. Gifting/Medicaid-Compliant Annuity This strategy is usually used when long-term care is needed in the immediate future. It requires dividing the applicant’s assets into two shares: the “Gifted Share” and the “Medicaid-Compliant Annuity Share”. The gifted share is usually given to your children or an irrevocable trust for the children’s benefit. The Medicaid-compliant annuity share is used to purchase a special type of annuity that is not counted as an asset for Medicaid purposes. This annuity provides a monthly stream of income that can be used to pay for long-term care during the penalty period created by gifting. These are just a few of the options available for a spend down. Before you spend excess assets or income, meet with a trusted Ohio Medicaid attorney. Spending down assets may have unintended estate planning, Medicaid and tax consequences if not done carefully. Don't wait until it's too late, start planning for your future healthcare needs now. Your health and financial well-being are worth it. Call my office at 614-334-6850 to schedule a meeting so we can start planning today.